Global Risk Management Analysis on 8334497588, 965993300, 8082803007, 3533280093, 732201060, 225036255

Global risk management analysis reveals critical vulnerabilities for organizations with international operations, particularly concerning financial, cybersecurity, and regulatory challenges. The financial risks tied to currency fluctuations can significantly impact profitability. Additionally, the rise in cybersecurity threats poses a growing concern for businesses operating across borders. Regulatory compliance demands further scrutiny, as varying standards can complicate operations. Understanding these complexities is essential for developing effective risk mitigation strategies that ensure organizational resilience. What measures can be taken to navigate these multifaceted risks?

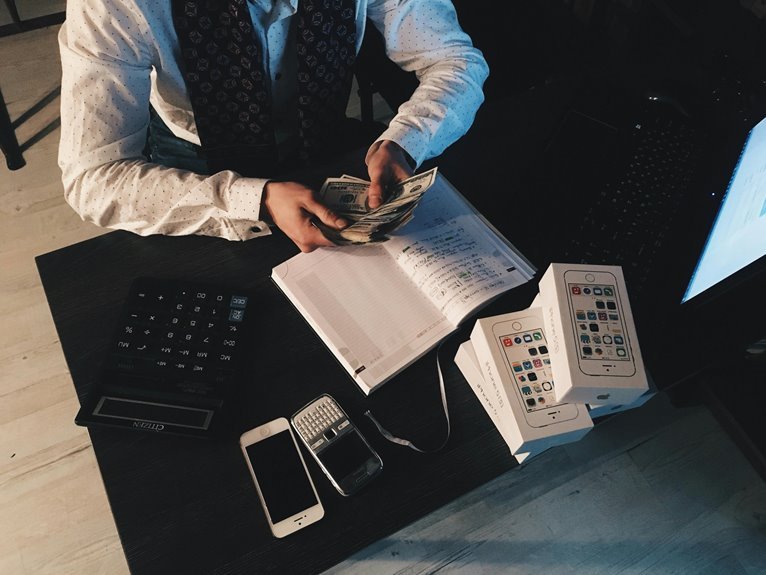

Identifying Financial Risks Associated With Global Operations

In the realm of global operations, financial risks emerge as critical factors influencing corporate stability and profitability.

Currency fluctuations can significantly impact revenue streams and operating costs, while geopolitical instability poses threats to market access and investment security.

Companies navigating these risks must adopt robust financial strategies to mitigate adverse effects, thereby ensuring resilience in an increasingly interconnected and unpredictable global economy.

Assessing Cybersecurity Threats in International Markets

Financial risks are not the only challenges confronting businesses in international markets; cybersecurity threats have emerged as a significant concern.

Organizations must adopt robust cybersecurity frameworks to mitigate these risks effectively.

Additionally, fostering international partnerships can enhance resilience against cyber attacks, allowing businesses to share resources, knowledge, and strategies.

This collaborative approach is vital for navigating the complex cybersecurity landscape in global operations.

Evaluating Regulatory Compliance Challenges

How can organizations effectively navigate the complex landscape of regulatory compliance in international markets?

They must understand diverse regulatory frameworks and conduct regular compliance audits to identify potential gaps. This analytical approach enables organizations to adapt strategies to meet varying requirements, ensuring adherence while fostering operational freedom.

Ultimately, a proactive stance on compliance challenges allows for sustainable growth in a global environment.

Implementing Best Practices for Risk Mitigation

Effective risk mitigation requires the implementation of best practices that align with an organization’s strategic objectives.

Organizations engaged in cross border transactions must conduct thorough risk assessments to identify potential vulnerabilities.

Establishing robust frameworks for monitoring and reporting can enhance transparency.

Furthermore, fostering a culture of compliance and continuous improvement aids in addressing dynamic risks, ultimately safeguarding organizational integrity and promoting operational resilience.

Conclusion

In the intricate tapestry of global operations, each thread represents a distinct risk that organizations must navigate. Financial fluctuations loom like storm clouds, while cybersecurity threats resemble lurking shadows, and regulatory compliance challenges manifest as tangled vines. To weave a resilient fabric, companies must integrate robust strategies, fostering collaboration and vigilance. By transforming these risks into opportunities for growth, businesses can anchor themselves against the tempest, ensuring a steady course through the unpredictable seas of the international market.